This time it is very posetive that Spain is in the bottom as the inflation continues to be one of the lowest in europe.

Many remember that, the financial crisis of 2008 had a significant impact on both inflation and economic activity in Spain

The collapse of the housing market and the subsequent recession led to a sharp decrease in aggregate demand, which resulted in deflation.

Spain experienced a period of negative inflation, or deflation, from 2008 to 2013, as the general price level of goods and services fell.

The crisis also led to a significant increase in unemployment, which further contributed to the deflationary pressures.

As companies struggled to survive, they cut costs, including wages, leading to a decrease in consumer spending, and further exacerbating the deflationary spiral.

The Spanish government intervened to stabilize the financial system by providing financial assistance to banks and implementing economic and financial reforms.

However, these measures, along with the ongoing economic crisis, led to an increase in public debt and caused a loss of confidence in the Spanish government’s ability to handle the crisis.

Overall, the financial crisis in Spain had a significant impact on inflation and economic activity, with the country experiencing a period of deflation in the years immediately following the crisis.

However, the inflation rate in Spain has been recovering and has until recently been above the average of the Eurozone but right now it is much better than the Eurozone

The good news

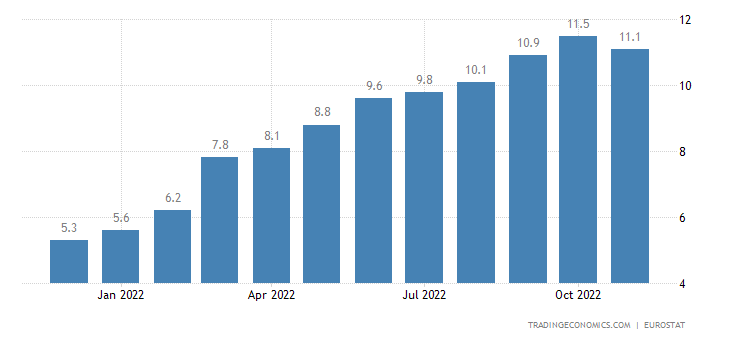

According to trading economics Spain continue the trend to be in th bottom of the inflation

Spain 5,7% in December 2022

source: tradingeconomics.com

this is compared to England, Germany, Sweeden and Denmark much lower.

United Kingdom 10,5% in December 2022

source: tradingeconomics.com

Sweeden 12,3% in December 2022

source: tradingeconomics.com

Denmark 8,7% in December 2022

source: tradingeconomics.com

Germany 8,6% in December 2022

source: tradingeconomics.com

Costa del Sol

On Costa del Sol the Real Estate sector is still in a fast pace with many costumers looking to buy a house.. Specially Apartments and villas from € 800.000 is attractive and there are only a few signs that the demand is slowing down a litle.

The area has a lack of supply of attractive homes wich is also the reason why the properties for sale keeps their value.

With high energy costs for heating and the fact that you don’t need as much in winter on the Costa del Sol, together with a more relaxed lifestyle, the area remains the most well-thought-out place to buy a second home in Europe

The total Eurozone list for December

Below is the complete list from trading economic.

| Country | Last | Previous | Reference | Unit |

|---|---|---|---|---|

| Liechtenstein | 2.8 | 3 | Dec/22 | % |

| Switzerland | 2.8 | 3 | Dec/22 | % |

| Luxembourg | 5.4 | 5.9 | Dec/22 | % |

| Spain | 5.7 | 6.8 | Dec/22 | % |

| France | 5.9 | 6.2 | Dec/22 | % |

| Norway | 5.9 | 6.5 | Dec/22 | % |

| Greece | 7.2 | 8.5 | Dec/22 | % |

| Malta | 7.3 | 7.2 | Dec/22 | % |

| Albania | 7.4 | 7.9 | Dec/22 | % |

| Cyprus | 7.9 | 8.7 | Dec/22 | % |

| Ireland | 8.2 | 8.9 | Dec/22 | % |

| Germany | 8.6 | 10 | Dec/22 | % |

| Denmark | 8.7 | 8.9 | Dec/22 | % |

| Faroe Islands | 8.8 | 7.3 | Sep/22 | % |

| Finland | 9.1 | 9.1 | Dec/22 | % |

| Euro Area | 9.2 | 10.1 | Dec/22 | % |

| Iceland | 9.6 | 9.3 | Dec/22 | % |

| Netherlands | 9.6 | 9.9 | Dec/22 | % |

| Portugal | 9.6 | 9.9 | Dec/22 | % |

| Austria | 10.2 | 10.6 | Dec/22 | % |

| Slovenia | 10.3 | 10 | Dec/22 | % |

| Belgium | 10.35 | 10.63 | Dec/22 | % |

| United Kingdom | 10.5 | 10.7 | Dec/22 | % |

| European Union | 11.1 | 11.5 | Nov/22 | % |

| Italy | 11.6 | 11.8 | Dec/22 | % |

| Russia | 11.9 | 12 | Dec/22 | % |

| Kosovo | 12.1 | 11.6 | Dec/22 | % |

| Sweden | 12.3 | 11.5 | Dec/22 | % |

| Belarus | 12.8 | 13.3 | Dec/22 | % |

| Croatia | 13.1 | 13.5 | Dec/22 | % |

| Macedonia | 14.2 | 19.5 | Dec/22 | % |

| Serbia | 15.1 | 15.1 | Dec/22 | % |

| Slovakia | 15.4 | 15.4 | Dec/22 | % |

| Czech Republic | 15.8 | 16.2 | Dec/22 | % |

| Bosnia and Herzegovina | 16.3 | 17.4 | Nov/22 | % |

| Romania | 16.37 | 16.76 | Dec/22 | % |

| Poland | 16.6 | 17.5 | Dec/22 | % |

| Bulgaria | 16.9 | 16.9 | Dec/22 | % |

| Montenegro | 17.2 | 17.5 | Dec/22 | % |

| Estonia | 17.6 | 21.3 | Dec/22 | % |

| Latvia | 20.8 | 21.8 | Dec/22 | % |

| Lithuania | 21.7 | 22.9 | Dec/22 | % |

| Hungary | 24.5 | 22.5 | Dec/22 | % |

| Ukraine | 26.6 | 26.5 | Dec/22 | % |

| Moldova | 30.24 | 31.41 | Dec/22 | % |

| Turkey | 64.27 | 84.39 | Dec/22 | % |