Looking for a Mortgage in Spain: A Comprehensive Guide

Securing a mortgage in Spain involves several steps and considerations, whether you’re a resident or a foreigner. The process can be straightforward if you understand the requirements, types of mortgages available, and the costs involved.

Understanding the Spanish Mortgage Market

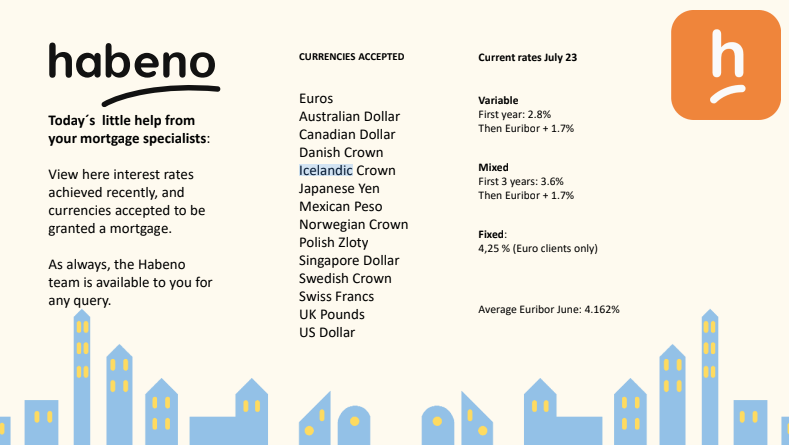

Spain offers a variety of mortgage options, including fixed-rate, variable-rate, and mixed-rate mortgages. Each type has its advantages and suitability depending on your financial situation and market conditions.

- Fixed-Rate Mortgages: These have a constant interest rate throughout the loan term, providing stability and predictability in monthly payments.

- Variable-Rate Mortgages: The interest rate fluctuates based on the Euribor (Euro Interbank Offered Rate) plus a margin set by the bank. Payments can vary significantly with changes in the market rate.

- Mixed-Rate Mortgages: These combine fixed and variable rates, typically offering a fixed rate for an initial period (e.g., 5 years) followed by a variable rate.

Requirements for Obtaining a Mortgage

To secure a mortgage in Spain, you need to meet certain criteria and provide specific documents. The requirements can vary slightly between banks but generally include:

- Proof of Income: Pay slips, tax returns, or bank statements to demonstrate your ability to repay the loan.

- Credit History: A good credit score and history of managing debts.

- Identification Documents: Passport, NIE (Número de Identificación de Extranjero) for foreigners, and a Spanish ID for residents.

- Property Valuation: The bank will require an official appraisal of the property to determine its market value.

Costs Involved in Getting a Mortgage

When applying for a mortgage in Spain, be prepared for various costs beyond the monthly repayments:

- Arrangement Fee: Banks typically charge a fee for arranging the mortgage, which can range from 0.5% to 1.5% of the loan amount.

- Property Valuation Fee: The cost for the property valuation, usually around 300 to 500 euros.

- Notary Fees: Legal fees for the notary public who oversees the signing of the mortgage deed.

- Land Registry Fees: Fees for registering the mortgage with the land registry.

- Stamp Duty: A tax on the mortgage deed, varying by region but generally around 1% to 2%.

Steps to Apply for a Mortgage

- Research and Compare Offers: Investigate different banks and their mortgage products. Use online comparison tools and consult mortgage brokers for advice.

- Prepare Documentation: Gather all necessary documents, including proof of income, identification, and details of the property.

- Submit Application: Apply to your chosen bank, either directly or through a broker. Provide all required documentation.

- Property Valuation: The bank will arrange for an official appraisal of the property.

- Approval and Offer: If your application is approved, the bank will issue a mortgage offer outlining the terms and conditions.

- Sign the Mortgage Deed: Finalize the mortgage by signing the deed in the presence of a notary public.

- Registration: The mortgage must be registered with the land registry to be legally binding.

Tips for Foreign Buyers

- Seek Local Advice: Engage with local real estate agents, lawyers, and mortgage brokers who understand the Spanish market and legal requirements.

- Understand Legal Obligations: Ensure you are aware of all legal obligations, including taxes and fees associated with property purchase and mortgage in Spain.

- Currency Exchange Considerations: If you are financing your mortgage with income from another currency, consider the impact of exchange rate fluctuations.

Conclusion

Looking for a mortgage in Spain requires careful planning and understanding of the local market.

By researching different mortgage options, preparing the necessary documentation, and being aware of the associated costs, you can navigate the process smoothly.

Whether you are a resident or a foreigner, seeking professional advice and thoroughly comparing offers will help you secure the best mortgage for your needs.

You can fill out the form online and search her

Need a property for your mortgage search here